TORONTO — Canada’s largest travel insurance provider has announced that it will start offering coverage for COVID-19 next month, giving travellers across the country some much needed peace of mind.

Coming this October, the Manulife COVID-19 Pandemic Travel Plan will be available to Canadians travelling both in Canada and internationally, including to countries with a Level 3 Travel Advisory. Through the plan, Manulife will provide Emergency Medical coverage, including specific additional coverage for COVID-19 and related conditions. It will also include added Trip Interruption benefits in the event of a quarantine.

Canadians can obtain the policy through Manulife’s distribution channels, including travel agents, brokers, advisors, sponsors as well as for direct purchase through Manulife CoverMe.

According to Alex Lucas, Head of Insurance at Manulife, the insurance provider understands that some Canadians have family, business and other important reasons for travelling in-country and to global destinations, and that specialized coverage is needed now more than ever to protect them in the event they fall ill due to COVID-19.

“The pandemic has had extraordinary impacts on the day-to-day lives of Canadians, and at Manulife our top priority remains the health and safety of our customers, employees, partners and communities,” he said. “This specialized travel insurance is aimed at helping protect what matters most.”

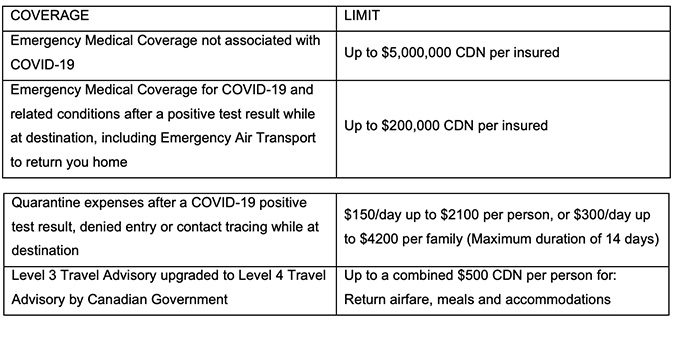

The policy will provide the following coverage: