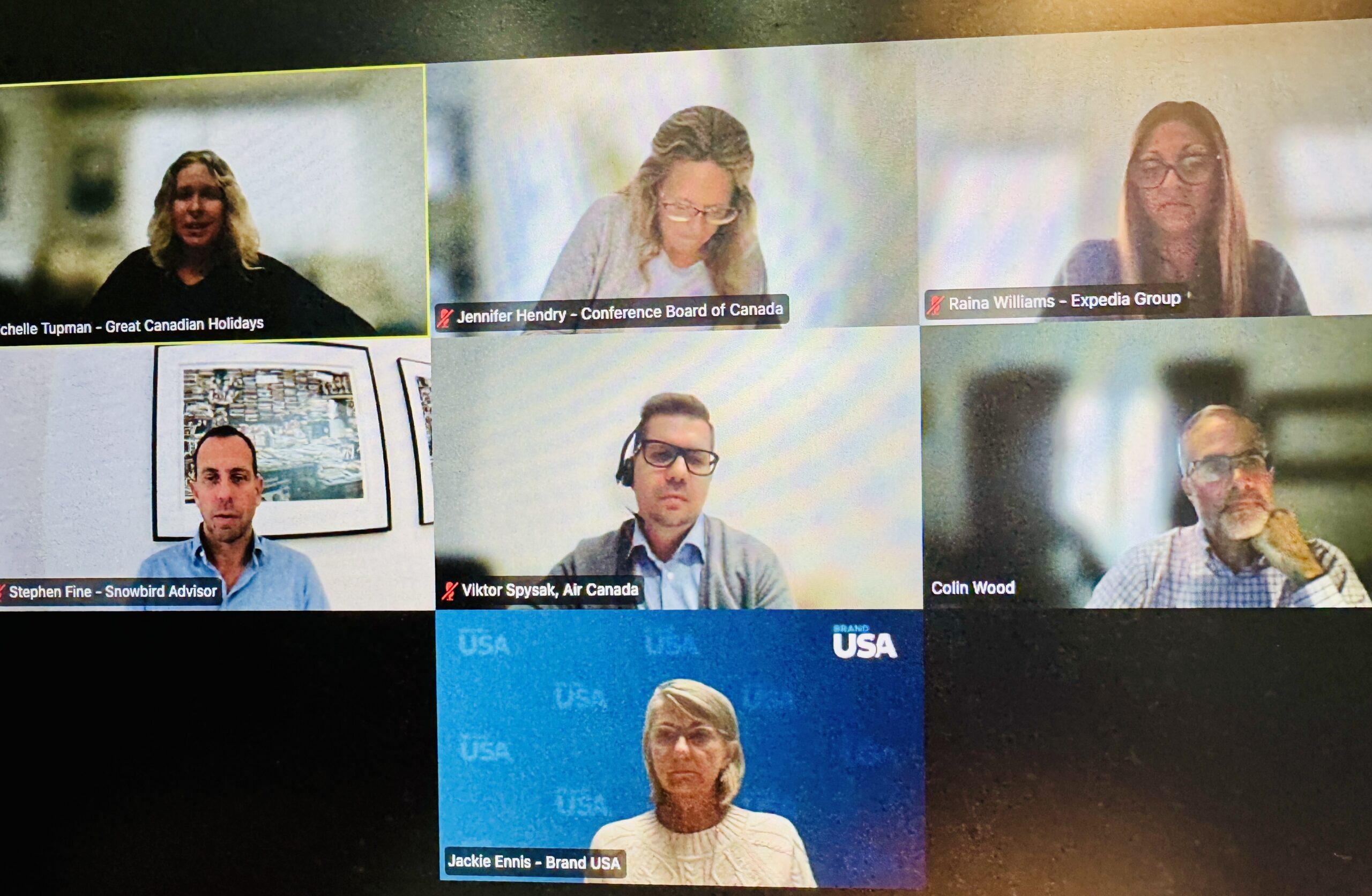

TORONTO — Industry experts from across the board – a tour operator, a travel retailer, an airline, Brand USA and more – shared what’s happening now and what’s ahead for Canada-U.S. travel at Discover America Canada’s ‘State of the Industry’ online panel discussion.

Moderated by VoX International’s Colin Wood, who also serves as Director for Discover America Canada (DAC), the panel included …

- Jackie Ennis, VP, Global Trade Development, Brand USA

- Jennifer Hendry, Lead Research Associate, Canadian Tourism Research Institute Lead, Economic Forecasting at The Conference Board of Canada

- Michelle Tupman, GM, Great Canadian Holidays and Coaches

- Raina Williams – Sr. Regional Manager, Expedia Group Media Solutions and VP, DAC

- Viktor Spysak, Manager, Sales and Tourism Partnerships, Air Canada and VP, DAC

- Stephen Fine, founder, Snowbird Advisor and Secretary Treasurer, DAC

The panelists shared stats, intel and insights on outbound U.S. travel from Canada, on the heels of nine months of consecutive declines in land travel from Canada to the U.S.

“Weʻre down 745,000 fewer land visitors,” travelling from Canada to the U.S., said Hendry. “The drop is widespread across the country, with every single border province showing decline. Currently, land travel is down 32% YOY. Air travel is a little bit different. Itʻs not doing as poorly as auto, but itʻs still down about 20%.”

Hendry added that while many Canadians are turning away from U.S. travel, they’re travelling to other destinations in droves. “Trips to non-U.S. destinations are on the rise. Theyʻre up 9% year over year, compared to 2024 and they now account for 47% of all outbound activity. Year to date, that percentage was 39% both last year and in 2019. The overall outbound market is still travelling.”

MEXICO OVERTAKES CANADA AS TOP INBOUND MARKET INTO U.S.

Even with the considerable drops in cross border travel, annual visitation from Canada to the U.S. is pegged at 16 million, “and 16 million people is still a lot of people,” said Brand USA’s Ennis.

Long enjoying top spot as the number one inbound market to the U.S., Canada has been overtaken by Mexico over the last couple of months, “mainly because of Canadaʻs decline and Mexicoʻs increase,” said Ennis.

“Those [Canadian] travellers who have come to the U.S. over the last several months, I feel they feel very much welcomed,” she added. “Many states are providing specific campaigns to welcome Canadian travellers, trying to place people above politics. And I think all of that has been very encouraging and positive. Canada is still a vitally important market to inbound travel into the United States.”

Have the decreases in visitation from Canada bottomed out? Said Ennis: “We follow sentiment from more than 20 markets on a month by month basis, and in terms of what weʻve been seeing from Canada, the worst time was around April and May. Since then sentiment has definitely stabilized, and we actually gained three points in August. We feel like maybe the worst has past. Thatʻs what weʻre hoping for.”

Certainly in Q2 2025, Canadians’ demand for domestic travel was well ahead of their demand for U.S. travel, noted Expediaʻs Williams.

Looking at winter travel trends, Williams added that across Expedia group users in Canada, “nearly 50% are planning to take a vacation during the winter holidays. Thereʻs huge opportunity here for growth for everybody.”

“A LOT OF SENIORS ARE THE ‘ELBOWS UP’ MENTALITY”

The downturn in crossborder travel has had major impact for travel retailers and wholesalers across Canada.

Great Canadian Holidays and Coaches’ Tupman shared her frontline experience as a tour operator that focuses on the motorcoach market for travellers from primarily the Southern Ontario area.

“Seniors make up a large percentage of our travellers. Historically weʻve done a tremendous amount of business into the United States. Usually about 45%, that was our number last year, and itʻs dropped off almost completely,” said Tupman.

She added: “Weʻve lost at least 95% of our travel into the U.S. since since January 2025, and thatʻs presented a lot of challenges. Weʻve had to pivot quickly to try to increase our Canadian product, and put some other international options out there.”

When Tupman and her team put out feelers for U.S. tours, the response from Canadians is intense: “Our clients really are not looking to see us advertising American destinations, and weʻre met with some pretty swift backlash when we do. Weʻre seeing maybe just the odd U.S. tour materialize with sort of break even level numbers. It really isnʻt shifting yet.”

Thankfully domestic travel has been booming for Great Canadian Holidays and Coaches. The Maritimes, Quebec City and the Eastern Townships have all been selling well, said Tupman.

There are certain U.S. destinations that will likely weather the downturns better than others, given their bucket list status among many Canadian travellers. Tupman cited NYC for its Broadway shows, Nashville for its music scene and Arizona and the Grand Canyon. Sports travel is also resilient.

An older clientele comes with advantages and disadvantages in this new climate, she added. “Some seniors are very much the ʻelbows upʻ [mentality]. The sentiment is really not great at the moment. However, thereʻs another group of people who are realizing ‘I only have so many healthy years to travel, this is something that is really important to me,’ and maybe they put it above politics. Finding what those things are, that are going to make people overcome those real or perceived barriers is, I think, a good approach.”

AIR CANADA “CAUTIOUSLY RESTARTING” MARKETING FOR U.S. DESTINATIONS: SPYSAK

Air Canada’s Spysak said the leisure market currently is performing better than non-leisure to the U.S. for Air Canada. And demand is building much closer to the departure. “Our booking window has reduced, which suggests that a lot of travellers are making last-minute decisions,” said Spysak.

Air Canada – along with just about every other airline serving Canada-U.S. routes – has made capacity adjustments these past many months.

“I wouldnʻt say it was a dramatic decrease, but it was a decrease that would meet the existing demand.”

Spysak added: “The good news is, weʻre growing our network in the U.S. We recently announced three new destinations that will be starting next summer as summer seasonal routes: Columbus, Cleveland and San Antonio. In these circumstances of relative uncertainty, we see some positive signs and growing demand for certain experiences, certain destinations. We also carry, of course, a lot of [what the airline industry calls] sixth freedom travellers, and in our case thatʻs air passengers from other countries traveling via Canada to the U.S. That helps us sustain the numbers.”

Air Canada is “cautiously restarting” some of its marketing activities for U.S. destinations. “We donʻt do it as a hard sell, but rather to remind our audience and our travellers of the routes and the destinations that we serve.”

Spysak added that Air Canada is seeing very strong demand for Caribbean destinations, and Mexico. “Weʻve added extra capacity on flights to the Bahamas, Jamaica, Belize and many other destinations in the region. We also launched new flights this winter to Rio, Santiago, Lima and Cartagena. The demand is there.

“We understand thereʻs quite a few travellers that havenʻt decided yet on where they are going to go. And to me, personally, travelling to the U.S. offers a perfect opportunity because of the short flight time.You can travel to Asia, you can travel to many other warm destinations, but given your flight time, especially for families with kids, the U.S. has so much to offer,” said Spysak.

“SOME ARE RETURNING ENTHUSIASTICALLY TO THE U.S.”

About one million Canadian snowbirds go away for the winter, and historically, it’s been an 80/20 split in terms of snowbirds who go to the U.S. versus international markets, said Snowbird Advisor’s Fine.

“This year itʻs really a mixed bag. Weʻre hearing from some snowbirds that are adamant that they wonʻt go to the U.S. under the current environment. Others are saying that theyʻre reluctantly going to go back, and others are enthusiastically returning to the U.S.” he said.

Plenty of Canadian snowbirds have expressed interest in international destinations for their winter long-stays.

How much of that interest will translate into action? Time will tell in this first full winter season of the new normal for crossborder travel, said Fine. “Weʻre getting close to snowbird season, and people are starting to leave now, and more people will be leaving the end of October and throughout the fall and the winter.”

In normal times some 70% of snowbirds drive to their winter destination. “If they want to continue to drive, the U.S. is really their only option. It will be interesting to see what the drive numbers are like if we see more vehicles crossing the border in the next three, four or five months to go to the U.S.,” said Fine.

About 30% of snowbirds own properties in the U.S., he added. “If they own a property, theyʻre more likely to go there than let it sit empty for the winter, and many snowbirds also have communities and friends that they go down to see for the winter. Weʻre still seeing strong interest in Florida, and South Carolina, and a few other of the hot spots in the United States.”

Fine noted demographic differences too. “Older travellers are typically a lot more politically connected and are much more adamant in ensuring that actions meet their values. Younger travellers are getting a little bit tired of the rhetoric. The predominant issue [for them] is cost and the exchange rate. Travel is a number one experience to make memories, and so that is also an opportunity: focusing on the markets that have the most likelihood to to ignore some of the larger global issues.”

Panelists take part in Discover America Canada’s ‘State of the Industry’ online discussion